Modern Macro: A New Approach to an Old Strategy

- We expect gyrations across assets, ranging from the U.S. dollar to Treasuries to commodities, will continue to provide a fertile landscape for macro investing.

- However, we believe the heightened uncertainty, resulting short-term volatility, and liquidity freezes may challenge more traditional approaches that lack the agility to tactically adjust positions.

- We believe the fragile market environment calls for a more dynamic approach – one that seeks to monetize not just the trends, but the volatility around the trends, while defending against a widening range of outcomes.

Macro investing is enjoying a renaissance. In 2022, as most asset prices sank amid sharply rising interest rates, macro hedge funds generated their strongest returns in several years.

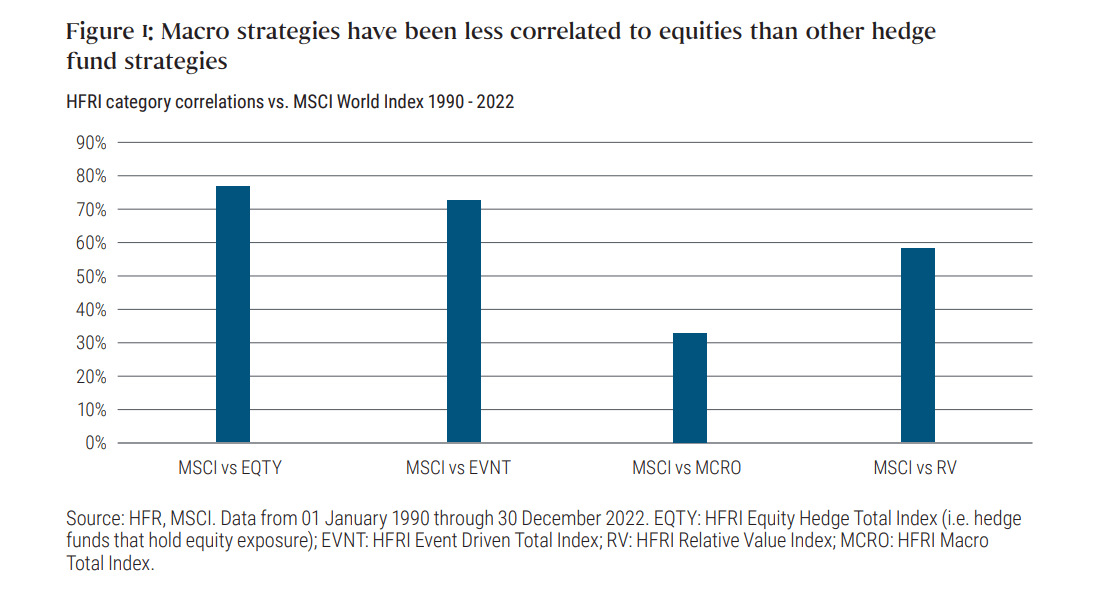

This is not surprising: The macro style of investing – in which managers invest based on their outlook for the economy and geopolitical events – has historically performed well when markets, particularly equity markets, have experienced large moves. With this in mind, investors seeking diversification from equity portfolios (see Figure 1) have poured $7.3 billion in net inflows into macro fundsFootnote1 over the last three years.

We expect that gyrations across assets – ranging from the U.S. dollar to Treasuries to commodities – will continue to provide a fertile landscape for macro investing. Yet, we believe the increasingly uncertain and fragile market environment calls for a more dynamic, nimble approach to the strategy – one that seeks to monetize not just the trends, but the volatility around the trends, while defending against a widening range of outcomes. This more modern approach will, in our view, likely outperform its more traditional counterparts.

Traditional macro strategies have evolved

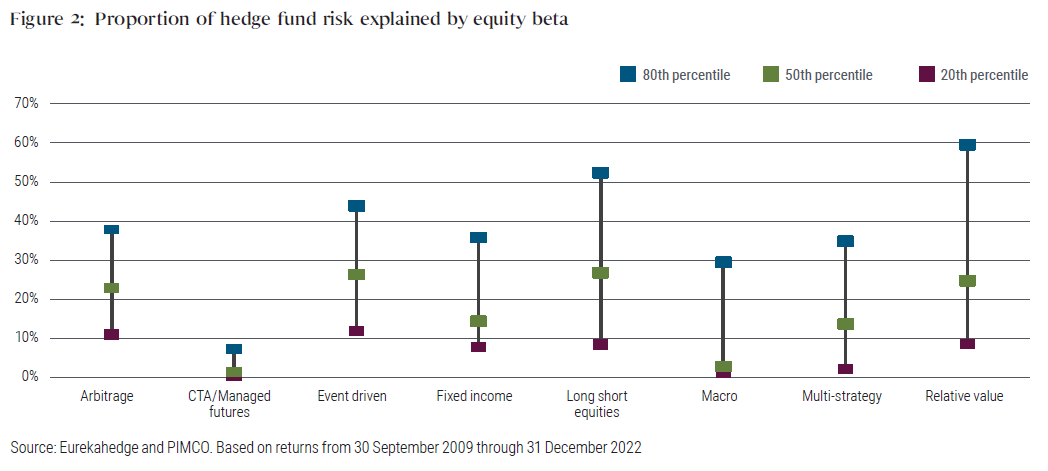

To see why we advocate a more dynamic, nuanced approach to macro investing, it is important to understand how most macro funds operate. Contrary to the 1980s, when macro strategies first took hold, managers now use more than just a handful of trades to execute their views. All too often, however, trades remain highly correlated with each other, with only secondary consideration paid to trade expression (the choice of securities used to express the market theme in question), market timing, or tactical adjustments. In many cases, the result is a return stream with a higher proportion of returns exhibiting traditional betas, namely equities --- even if macro as a category generally exhibits much less of this than other types of funds (see Figure 2).

Going forward, while we expect the set of macro opportunities to remain rich, we believe heavy uncertainty, ongoing spikes in market volatility and recurring liquidity crises will challenge these approaches, especially on a risk-adjusted basis:

Heightened market uncertainty. A recent surveyFootnote2 showed the widest range of long-term inflation expectations in 30 years, and, in spite of the current high inflation environment, an all-time high percentage of respondents expecting long-term deflation. An environment as uncertain as this requires true diversification, and heightens the need for asymmetric trade expressions (in which the potential upside is greater than the downside).

Higher short-term volatility. Central Bank tightening has drained market liquidity and heightened volatility. At the same time, post-global financial crisis regulations have limited broker-dealers’ ability to step in and act as a backstop, leading to larger flow-driven asset price moves. And the rise of trend-following strategies is only compounding these price moves. Wild day-to-day volatility makes holding even ultimately winning positions difficult – underscoring the importance of overlaying a core macro view with tactical trading to defend against, and even profit from, the volatility around the core macro view.

Liquidity freezes. Episodes in which market liquidity rapidly and dramatically evaporates are becoming more frequent and severe. With many rushing for the exit, consensus positions, especially carry trades (which borrow at low rates and lend at higher rates in currencies or other instruments), can become significantly challenged. Historically, managers would often pair directional bets with low-frequency carry strategies (which trade less often). However, with carry strategies more frequently coming under pressure, managers will need to find alternative sources of diversified return.

PIMCO’s modern approach to macro investing

At PIMCO, we have a differentiated approach. While our core macroeconomic views provide the “guardrails” for our portfolios, we couple those views with a robust three-pronged framework to help better monetize those views for our clients:

- Trade around our core positions. We use a range of positioning, flow-based and cross-asset indicators to tactically adjust our positions around our core macro views.

- Mitigate downside risk. We focus on developing asymmetric trade expressions to best capture our core macro views and manage portfolio risk should our base cases not materialize.

- Use a range of complementary strategies. We pair our core macro strategies with systematic and relative value strategies to seek a more diversified, consistent return stream.

As an example, consider our approach to the market moves we anticipated as the Fed began quantitative tightening last year. Although the 2-year interest rate soared from 1.5% to 4.5% in March through December 2022, the move was far from uniform, with multiple pullbacks, including an almost 100-basis- point counter-trend move in July and August. Managers who used suboptimal trade expressions or who were unwilling or unable to tactically adjust their positions, were often forced to exit them during pullbacks.

In contrast, we were able to use our flow-based indicators to adjust our positions and buy cheap hedges as the global quantitative tightening trade took hold. We also opted to express the theme via U.S. and Asian interest rate derivatives, including options, which appeared more mispriced than U.S. Treasuries. Finally, we had a number of market-neutral systematic strategies running in the background, providing both diversification and potential positive return streams.

Conclusion

We believe today’s more volatile, less liquid environment demands a more nimble, nuanced, and modern approach. Returns from traditional approaches could be buffeted by significant volatility in longer-term trends. More agile managers can monetize not just the trend, but the significant localized volatility around that trend. Managers will also need to give more consideration to the securities used in a trade in order to mitigate risks of an increasingly wider range of potential outcomes. Those adaptations should help managers pair macro-dependent returns with a more regular, recurring return stream.

Download PDF

1 Hedge Fund Research (HFR), Inc. Return to content

2 University of Michigan Consumer Expectations Survey on 5-10 year ahead inflation as of July 2022. Return to content

Featured Participants

Disclosures

Past performance is not a guarantee or a reliable indicator of future results.

All investments contain risk and may lose value. Hedge fund and other alternatives strategies involve a high degree of risk and prospective investors are advised that these strategies are suitable only for persons of adequate financial means who have no need for liquidity with respect to their investment and who can bear the economic risk, including the possible complete loss, of their investment. Performance could be volatile; an investment in a fund may lose money.

There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest long-term, especially during periods of downturn in the market.

Correlation is a statistical measure of how two securities move in relation to each other. The correlation of various indexes or securities against one another or against inflation is based upon data over a certain time period. These correlations may vary substantially in the future or over different time periods that can result in greater volatility.

This material contains the opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. It is not possible to invest directly in an unmanaged index. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This is not an offer to any person in any jurisdiction where unlawful or unauthorized. | Pacific Investment Management Company LLC, 650 Newport Center Drive, Newport Beach, CA 92660 is regulated by the United States Securities and Exchange Commission. | PIMCO Europe Ltd (Company No. 2604517, 11 Baker Street, London W1U 3AH, United Kingdom) is authorised and regulated by the Financial Conduct Authority (FCA) (12 Endeavour Square, London E20 1JN) in the UK. The services provided by PIMCO Europe Ltd are not available to retail investors, who should not rely on this communication but contact their financial adviser. | PIMCO Europe GmbH (Company No. 192083, Seidlstr. 24-24a, 80335 Munich, Germany), PIMCO Europe GmbH Italian Branch (Company No. 10005170963, Corso Vittorio Emanuele II, 37/Piano 5, 20122 Milano, Italy), PIMCO Europe GmbH Irish Branch (Company No. 909462, 57B Harcourt Street Dublin D02 F721, Ireland), PIMCO Europe GmbH UK Branch (Company No. FC037712, 11 Baker Street, London W1U 3AH, UK), PIMCO Europe GmbH Spanish Branch (N.I.F. W2765338E, Paseo de la Castellana 43, Oficina 05-111, 28046 Madrid, Spain) and PIMCO Europe GmbH French Branch (Company No. 918745621 R.C.S. Paris, 50–52 Boulevard Haussmann, 75009 Paris, France) are authorised and regulated by the German Federal Financial Supervisory Authority (BaFin) (Marie- Curie-Str. 24-28, 60439 Frankfurt am Main) in Germany in accordance with Section 15 of the German Securities Institutions Act (WpIG). The Italian Branch, Irish Branch, UK Branch, Spanish Branch and French Branch are additionally supervised by: (1) Italian Branch: the Commissione Nazionale per le Società e la Borsa (CONSOB) (Giovanni Battista Martini, 3 - 00198 Rome) in accordance with Article 27 of the Italian Consolidated Financial Act; (2) Irish Branch: the Central Bank of Ireland (New Wapping Street, North Wall Quay, Dublin 1 D01 F7X3) in accordance with Regulation 43 of the European Union (Markets in Financial Instruments) Regulations 2017, as amended; (3) UK Branch: the Financial Conduct Authority (FCA) (12 Endeavour Square, London E20 1JN); (4) Spanish Branch: the Comisión Nacional del Mercado de Valores (CNMV) (Edison, 4, 28006 Madrid) in accordance with obligations stipulated in articles 168 and 203 to 224, as well as obligations contained in Tile V, Section I of the Law on the Securities Market (LSM) and in articles 111, 114 and 117 of Royal Decree 217/2008, respectively and (5) French Branch: ACPR/Banque de France (4 Place de Budapest, CS 92459, 75436 Paris Cedex 09) in accordance with Art. 35 of Directive 2014/65/EU on markets in financial instruments and under the surveillance of ACPR and AMF. The services provided by PIMCO Europe GmbH are available only to professional clients as defined in Section 67 para. 2 German Securities Trading Act (WpHG). They are not available to individual investors, who should not rely on this communication. | PIMCO (Schweiz) GmbH (registered in Switzerland, Company No. CH-020.4.038.582-2, Brandschenkestrasse 41 Zurich 8002, Switzerland). The services provided by PIMCO (Schweiz) GmbH are not available to retail investors, who should not rely on this communication but contact their financial adviser. | PIMCO Asia Pte Ltd (Registration No. 199804652K) is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence and an exempt financial adviser. The asset management services and investment products are not available to persons where provision of such services and products is unauthorised. | PIMCO Asia Limited is licensed by the Securities and Futures Commission for Types 1, 4 and 9 regulated activities under the Securities and Futures Ordinance. PIMCO Asia Limited is registered as a cross-border discretionary investment manager with the Financial Supervisory Commission of Korea (Registration No. 08-02-307). The asset management services and investment products are not available to persons where provision of such services and products is unauthorised. | PIMCO Investment Management (Shanghai) Limited Unit 3638-39, Phase II Shanghai IFC, 8 Century Avenue, Pilot Free Trade Zone, Shanghai, 200120, China (Unified social credit code: 91310115MA1K41MU72) is registered with Asset Management Association of China as Private Fund Manager (Registration No. P1071502, Type: Other) | PIMCO Australia Pty Ltd ABN 54 084 280 508, AFSL 246862. This publication has been prepared without taking into account the objectives, financial situation or needs of investors. Before making an investment decision, investors should obtain professional advice and consider whether the information contained herein is appropriate having regard to their objectives, financial situation and needs. | PIMCO Japan Ltd, Financial Instruments Business Registration Number is Director of Kanto Local Finance Bureau (Financial Instruments Firm) No. 382. PIMCO Japan Ltd is a member of Japan Investment Advisers Association, The Investment Trusts Association, Japan and Type II Financial Instruments Firms Association. All investments contain risk. There is no guarantee that the principal amount of the investment will be preserved, or that a certain return will be realized; the investment could suffer a loss. All profits and losses incur to the investor. The amounts, maximum amounts and calculation methodologies of each type of fee and expense and their total amounts will vary depending on the investment strategy, the status of investment performance, period of management and outstanding balance of assets and thus such fees and expenses cannot be set forth herein. | PIMCO Taiwan Limited is an independently operated and managed company. The reference number of business license of the company approved by the competent authority is (110) Jin Guan Tou Gu Xin Zi No. 020 . The registered address of the company is 40F., No.68, Sec. 5, Zhongxiao East Rd., Xinyi District, Taipei City 110, Taiwan (R.O.C.), and the telephone number is +886 2 8729-5500. | PIMCO Canada Corp. (199 Bay Street, Suite 2050, Commerce Court Station, P.O. Box 363, Toronto, ON, M5L 1G2) services and products may only be available in certain provinces or territories of Canada and only through dealers authorized for that purpose. | PIMCO Latin America Av. Brigadeiro Faria Lima 3477, Torre A, 5° andar São Paulo, Brazil 04538-133. | No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world. ©2023 PIMCO.

CMR2023-0221-2751383