Inflation

- Commodities: A commodity is food, metal, or another fixed physical substance that investors buy or sell, usually via futures contracts.

- Correlation: A statistical measure of how two securities, such as equities, bonds, commodities, move in relation to each other.

- Disinflation: A period of time when economic growth begins to slow, demand eases and the supply of goods increases relative to demand, and the rate of inflation usually drops.

- Equities: Ownership or proprietary rights and interests in a company.

- Fixed Income: Securities/Investments in which the income during ownership is fixed or constant. Generally refers to any type of bond investment.

- Hyperinflation: When economic growth accelerates very rapidly, and demand grows even faster, producers may also raise prices continually.

- Stagflation: A period of inflation combined with low growth and high unemployment.

Inflation affects all aspects of the economy, from consumer spending, business investment and employment rates to government programs, tax policies, and interest rates.

Understanding inflation is crucial to investing because it can reduce the value of investment returns. With inflation rising recently after several years of relative calm to its highest level in four decades, investors may benefit from knowing the factors driving inflation, the impact on their portfolios, and steps to consider as the investment landscape shifts.

WHAT IS INFLATION?

As an economy grows, businesses and consumers spend more money on goods and services. In the growth stage of an economic cycle, demand typically outstrips the supply of goods, and producers can raise their prices. As a result, the rate of inflation increases.

Inflation is a sustained rise in overall price levels. Moderate inflation is associated with economic growth, while high inflation can signal an overheated economy.

If economic growth accelerates very rapidly, demand grows even faster and producers raise prices continually. Supply constraints can also drive prices higher absent any material change in demand. An upward price spiral, sometimes called “runaway inflation” or “hyperinflation,” can result.

In the U.S., the inflation syndrome is often described as “too many dollars chasing too few goods;” in other words, as spending outpaces the production of goods and services, the supply of dollars in an economy exceeds the amount needed for financial transactions. The result is that the purchasing power of a dollar declines.

HOW IS INFLATION MEASURED?

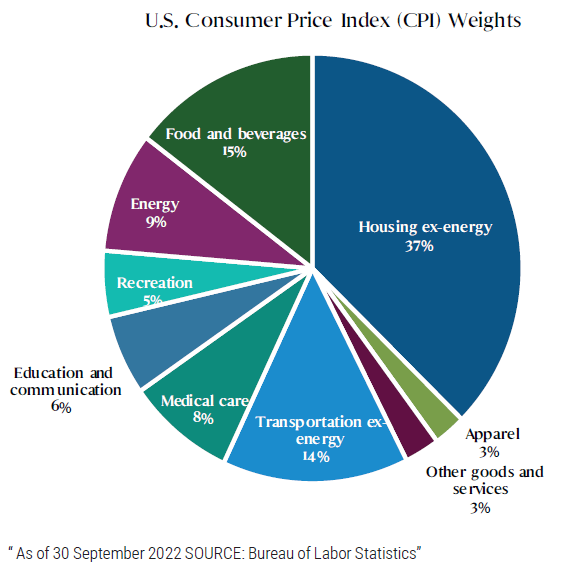

When economists and central banks try to discern the rate of inflation, they generally focus on “core inflation,” such as “core CPI” or “core PCE.” Unlike the inflation, core inflation excludes food and energy prices, which are subject to sharp, short-term price swings, and could give a misleading picture of long-term inflation trends.

There are several regularly reported measures of inflation that investors can use to track inflation. In the U.S., the Consumer Price Index (CPI), which reflects retail prices of goods and services including housing costs, transportation, and healthcare, is the most widely followed indicator. The Federal Reserve prefers to emphasize the Personal Consumption

Cost-push inflation in context

Both higher oil prices and depreciation of currency have previously caused cost-push inflation.

Example of Higher Oil Prices

- Higher oil prices have driven price increases across sectors of the global economy.

- In 2020-2022, oil inventories have hit low levels, causing prices to rise amid surging COVID-19 reopening demand and lagging supply.

- Rising oil prices take money out of the pockets of consumers and businesses.

- Economists view oil-price hikes as a “tax” that can affect economic conditions.

Suppy Chain Disruptions

- Supply chains worldwide drastically slowed since the emergence of the coronavirus in early 2020 due to disruptions in shipping and labor.

- This has caused shortages in materials and, in turn, higher prices for goods.

- The war in Ukraine has contributed to supply disruptions and higher prices.

WHAT CAUSES INFLATION?

Economists do not always agree on what spurs inflation at any given time, but in general they bucket the factors into two different types: cost-push inflation and demand-pull inflation.

Rising commodity prices are an example of cost-push inflation because when commodities rise in price, the costs of basic goods and services generally increase.

Demand-pull inflation occurs when aggregate demand in an economy rises too quickly. This can occur if a central bank rapidly increases the money supply without a corresponding increase in the production of goods and service. Demand outstrips supply, leading to an increase in prices.

Expenditures Price Index (PCE). This is because the PCE covers a wider range of expenditures than the CPI. The official measure of inflation of consumer prices in the UK is the Consumer Price Index (CPI), or the Harmonized Index of Consumer Prices (HICP). In the eurozone, the main measure used is also called the HICP.

HOW CAN INFLATION BE CONTROLLED?

Central banks, such as the U.S. Federal Reserve, European Central Bank, the Bank of Japan and the Bank of England attempt to control inflation by regulating the pace of economic activity. They usually try to affect economic activity by raising and lowering short-term interest rates.

Management of the money supply by central banks in their home regions is known as monetary policy. Raising and lowering interest rates is the most common way of implementing monetary policy.

However, a central bank can also tighten or relax banks’ reserve requirements. Banks must hold a percentage of their deposits with the central bank or as cash on hand. Raising the reserve requirements restricts banks’ lending capacity, thus slowing economic activity, while easing reserve requirements generally stimulates economic activity.

A government at times will attempt to fight inflation through fiscal policy. The government can attempt to fight inflation by raising taxes or reducing spending, thereby putting a damper on economic activity; conversely, it can combat deflation with tax cuts and increased spending designed to stimulate economic activity.

HOW DOES INFLATION AFFECT INVESTMENT RETURNS?

Inflation poses a “stealth” threat to investors because it chips away at real savings and investment returns. Most investors aim to increase their long-term purchasing power. Inflation puts this goal at risk because investment returns must first keep up with the rate of inflation in order to increase real purchasing power.

For example, an investment that returns 2% before inflation in an environment of 3% inflation will actually produce a negative return (−1%) when adjusted for inflation.*

Also, importantly, changes in the inflation rate can have a different impact on various asset classes. For example, historically stocks and nominal fixed income have exhibited a negative response to upside surprises in inflation. This may result in a positive stock / bond correlation during periods of higher inflation and challenge traditional diversification. In contrast, real assets like commodities and Treasury Inflation-Protected Securities (TIPS), display a positive sensitivity historically.

WHAT MAY INFLATION MEAN FOR INVESTORS?

Very high inflation tends to have a negative impact on assets such as stocks and bonds. Maintaining a constant allocation to inflation-hedging assets can help investors cushion their portfolios against unexpected spikes.

WHAT STEPS CAN INVESTORS TAKE TO MITIGATE INFLATION’S IMPACT ON PORTFOLIOS?

Amid a rising inflation environment and constantly changing investment conditions, investors may want to to consider inflation-mitigating assets, as well as to keep in mind the core tenets of investing—maintaining a well-diversified portfolio, regular rebalancing, and ensuring investments remain aligned with long-term goals.

Disclosures

IMPORTANT NOTICE

Please note that the following contains the opinions of the manager as of the date noted and may not have been updated to reflect real time market developments. All opinions are subject to change without notice.

All investments contain risk and may lose value. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Commodities contain heightened risk, including market, political, regulatory and natural conditions, and may not be appropriate for all investors.

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM.

ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.

The Consumer Price Index (CPI) is an unmanaged index representing the rate of inflation of the U.S. consumer prices as determined by the U.S. Department of Labor Statistics. There can be no guarantee that the CPI or other indexes will reflect the exact level of inflation at any given time. The Personal Consumption Expenditures (PCE) deflator is published by the Bureau of Economic Analysis as part of the GDP report. It measures inflation across the basket of goods purchased by households, and is computed by taking the difference between current dollar PCE and chained dollar PCE. The Harmonised Indices of Consumer Prices (HICP) is an economic indicator that measures the changes over time in the prices of consumer goods and services acquired by households. The HICP gives a comparable measure of inflation in the euro-zone, the EU, the European Economic Area and for other countries including accession and candidate countries. It is calculated according to a harmonised approach and a single set of definitions. It also provides the official measure of consumer price inflation in the euro-zone for the purposes of monetary policy in the euro area and assessing inflation convergence as required under the Maastricht criteria. It is not possible to invest directly in an unmanaged index.

Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Outlook and strategies are subject to change without notice.

This material contains the current of the author but not necessarily those of PIMCO, and such opinions are subject to change without notice. This material ia distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This is not an offer to any person in any jurisdiction where unlawful or unauthorized. | Pacific Investment Management Company LLC, 650 Newport Center Drive, Newport Beach, CA 92660 is regulated by the United States Securities and Exchange Commission. | PIMCO Europe Ltd (Company No. 2604517) is authorised and regulated by the Financial Conduct Authority (12 Endeavour Square, London E20 1JN) in the UK. The services provided by PIMCO Europe Ltd are not available to retail investors, who should not rely on this communication but contact their financial adviser. | PIMCO Europe GmbH (Company No. 192083, Seidlstr. 24-24a, 80335 Munich, Germany), PIMCO Europe GmbH Italian Branch (Company No. 10005170963), PIMCO Europe GmbH Irish Branch (Company No. 909462), PIMCO Europe GmbH UK Branch (Company No. 2604517) and PIMCO Europe GmbH Spanish Branch (N.I.F. W2765338E) are authorised and regulated by the German Federal Financial Supervisory Authority (BaFin) (Marie- Curie-Str. 24-28, 60439 Frankfurt am Main) in Germany in accordance with Section 15 of the German Securities Institutions Act (WpIG). The Italian Branch, Irish Branch, UK Branch and Spanish Branch are additionally supervised by: (1) Italian Branch: the Commissione Nazionale per le Società e la Borsa (CONSOB) in accordance with Article 27 of the Italian Consolidated Financial Act; (2) Irish Branch: the Central Bank of Ireland in accordance with Regulation 43 of the European Union (Markets in Financial Instruments) Regulations 2017, as amended; (3) UK Branch: the Financial Conduct Authority; and (4) Spanish Branch: the Comisión Nacional del Mercado de Valores (CNMV) in accordance with obligations stipulated in articles 168 and 203 to 224, as well as obligations contained in Tile V, Section I of the Law on the Securities Market (LSM) and in articles 111, 114 and 117 of Royal Decree 217/2008, respectively. The services provided by PIMCO Europe GmbH are available only to professional clients as defined in Section 67 para. 2 German Securities Trading Act (WpHG). They are not available to individual investors, who should not rely on this communication.| PIMCO (Schweiz) GmbH (registered in Switzerland, Company No. CH-020.4.038.582-2). The services provided by PIMCO (Schweiz) GmbH are not available to retail investors, who should not rely on this communication but contact their financial adviser. | PIMCO Asia Pte Ltd (Registration No. 199804652K) is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence and an exempt financial adviser. The asset management services and investment products are not available to persons where provision of such services and products is unauthorised. | PIMCO Asia Limited is licensed by the Securities and Futures Commission for Types 1, 4 and 9 regulated activities under the Securities and Futures Ordinance. PIMCO Asia Limited is registered as a cross-border discretionary investment manager with the Financial Supervisory Commission of Korea (Registration No. 08-02-307). The asset management services and investment products are not available to persons where provision of such services and products is unauthorised. | PIMCO Investment Management (Shanghai) Limited Unit 3638-39, Phase II Shanghai IFC, 8 Century Avenue, Pilot Free Trade Zone, Shanghai, 200120, China (Unified social credit code: 91310115MA1K41MU72) is registered with Asset Management Association of China as Private Fund Manager (Registration No. P1071502, Type: Other) | PIMCO Australia Pty Ltd ABN 54 084 280 508, AFSL 246862. This publication has been prepared without taking into account the objectives, financial situation or needs of investors. Before making an investment decision, investors should obtain professional advice and consider whether the information contained herein is appropriate having regard to their objectives, financial situation and needs. | PIMCO Japan Ltd, Financial Instruments Business Registration Number is Director of Kanto Local Finance Bureau (Financial Instruments Firm) No. 382. PIMCO Japan Ltd is a member of Japan Investment Advisers Association, The Investment Trusts Association, Japan and Type II Financial Instruments Firms Association. All investments contain risk. There is no guarantee that the principal amount of the investment will be preserved, or that a certain return will be realized; the investment could suffer a loss. All profits and losses incur to the investor. The amounts, maximum amounts and calculation methodologies of each type of fee and expense and their total amounts will vary depending on the investment strategy, the status of investment performance, period of management and outstanding balance of assets and thus such fees and expenses cannot be set forth herein. | PIMCO Taiwan Limited is managed and operated independently. The reference number of business license of the company approved by the competent authority is (110) Jin Guan Tou Gu Xin Zi No. 020. 40F., No.68, Sec. 5, Zhongxiao E. Rd., Xinyi Dist., Taipei City 110, Taiwan (R.O.C.). Tel: +886 2 8729-5500. | PIMCO Canada Corp. (199 Bay Street, Suite 2050, Commerce Court Station, P.O. Box 363, Toronto, ON, M5L 1G2) services and products may only be available in certain provinces or territories of Canada and only through dealers authorized for that purpose. | PIMCO Latin America Av. Brigadeiro Faria Lima 3477, Torre A, 5° andar São Paulo, Brazil 04538-133. | No part of this publication may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America L.P. in the United States and throughout the world. ©2022, PIMCO.

CMR2022-1026-2553629